by Charity Yoro

On a Saturday afternoon in the spring, a group of Bryn Mawr College students walks down Main Street in Norristown, Pennsylvania. They enter the various restaurants and consignment stores on the block, but they aren’t buying lunch, clothes or furniture. They aren’t selling, canvassing, or campaigning either.

These students are spending their weekend mapping local businesses in a contest to win $20,000.

But the contest money won’t be used to buy the latest iPhone or designer bag. Instead, the money will be going back to directly support some of these same businesses as part of a new regional initiative called Lend for Philly.

For entrepreneurs with high ambitions and perhaps fewer opportunities, the problem lies in accessibility. Many low-income entrepreneurs in the U.S. lack access to capital, skills and a qualified labor pool to help start and grow their small businesses.

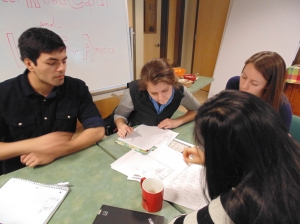

So to solve this problem, college students are meeting these businesses where they are: at their own storefronts.

Bryn Mawr College represents one of ten student teams competing in Lend for Philly, the pilot project of the non-profit Lend for America funded by Knight Foundation. The contest, ending in May, seeks to foster collaboration between college students and local entrepreneurs by challenging university teams to walk around their community and map small (or “micro”) businesses in the area.

“The experience has been easier than we expected,” says Irina Buchok, a freshman looking to major in Economics at Bryn Mawr College. “Most businesses are eager to participate.”

Most of the businesses the students interview are family-owned. Salons, restaurants, and bodegas alike, many of the establishments share the same needs for growing a clientele base, hiring reliable people, or seeking affordable venues for expansion.

The exercise of interviewing business owners has taken students from the classroom into the ‘field’ to learn the basics of business and finance on the ground, helping to break the barrier that often exists between college campuses and their outside communities.

The budding relationships formed with local businesses as part of Lend for Philly seem to have excited and inspired student participants to take action in their campus communities.

“In college, we have so many students looking for opportunities,” saysYaxuan Wen, student president of Bryn Mawr’s microfinance club and another Lend for Philly participant. “The feedback we’ve been getting from many business owners we’ve interviewed is that they want to recruit quality students to help grow their businesses.”

As a result of the contest, the students at Bryn Mawr, who met specifically because of Lend for Philly, hope to continue as a kind of “liaison between students and local businesses.” College students, Irina says, have skills in things like website building and marketing that could help meet the needs of these small establishments.

As part of Lend for Philly, the student team with the most businesses mapped, or ‘pinned,’ will receive $20,000 in funding to start a microbusiness development initiative on-campus; with part of the funds to be distributed to five to ten small loans to qualifying local businesses.

“There are a lot of opportunities for students to get involved on campus,” says Yaxuan. “But Lend for Philly has been a really motivating experience for us.”

The Lend for Philly contest leaderboard is open to the public at www.lendforphilly.org. Philly area based students have until May 1st to interview and map as many businesses as they can in their communities. For more information about this challenge and other grassroots opportunities, visit www.lendforamerica.org or email charity@lendforamerica.org.

Charity Yoro manages marketing and communications as an AmeriCorps VISTA for the non-profit Lend for America. She recently returned to the states after years of working abroad, where among other things, she directed village savings and loans programs with rural farmers and women’s groups in Madagascar. In her spare time, Charity runs The Rich Life, a lifestyle blog offering tips on living a “wealthy” life, with less.